Executive Summary

U.S. exporters are navigating a volatile Q2 landscape shaped by blank sailings, shifting port dynamics, and economic uncertainty. Carriers are strategically cutting capacity to stabilize rates and strengthen contract leverage - leaving exporters with fewer bookings and a higher risk of rolled cargo. East Coast volumes are surging, especially in Savannah, as freight diverts from congested or unreliable West and Gulf gateways.

Meanwhile, global chokepoints like the Panama Canal and Red Sea, along with looming labor unrest, are injecting new uncertainty into routing. If import demand rebounds in Q2/Q3, carriers may prioritize repositioning empty containers to Asia - sidelining U.S. ag exports and creating inland equipment shortages. Carbon efficiency mandates are also slowing vessels and reducing schedule flexibility.

Smart exporters are leveraging predictive tools, reassessing inland ramps and gateways, and renegotiating for flexibility.

The message is clear: those who prepare now will outperform those who wait.

Q2 Flashpoint

68 blank sailings. New tariff rumblings from the White House. For U.S. exporters of containerized agriculture, food, and commodities, April isn't just about planting season - it's about supply chain risk season.

The 68 blank sailings reported for the Transpacific, Transatlantic, and Asia-Europe trades from Weeks 14-18 (March 31-May 4, 2025) were not executed in one day. These cancellations are distributed over a five-week period and reflect weekly planned blank sailings by ocean carriers across the major East-West trades.

Multiple services, alliances, and port rotations were affected, each with its own schedule adjustments.

The “68 sailings” figure is a snapshot reported by Drewry as of March 28, 2025 (according to the JOC.com article “April blank sailings ramp up amid push to finalize long-term contracts”) reflecting how many individual weekly sailings were scheduled to be canceled across that window. Each typically represents a full loop cancellation, not isolated vessel issues. As a result, exporters are experiencing cumulative impacts that differ by week and lane. Meanwhile, whispers of new tariffs could reignite retaliatory trade measures not seen since the 2018-2020 trade war.

The convergence of these two forces should put every U.S. exporter and ag supply chain manager on high alert.

Why It’s Happening:

Recent data from JOC and eeSea suggest these blank sailings aren’t only a response to weak demand. Carriers are:

- Strategically blanking sailings to stabilize spot rates and manage overcapacity

- Recovering schedules post-Lunar New Year disruptions

- Adjusting services to maintain leverage during 2025 contract season negotiations (eeSea, 2025)

This means exporters aren’t just dealing with a temporary dip in demand - they’re navigating a deliberate, strategic capacity squeeze that affects vessel availability, inland flows, and booking reliability.

Why It Matters to You:

- Blank sailings = Rolled shipments. If your containers arrive at port but the vessel is pulled, you’re likely to miss the cargo cutoff. That means holding inventory, rescheduling labor, and scrambling for a new booking (Sea-Intelligence, 2019).

- Vessel schedule changes disrupt rail billing. Inland ramps can no longer move your containers when the ERD shifts. This creates backlogs, drives up per diem/storage costs, and disrupts chassis flows (Harrell, 2024a).

- Retaliatory tariffs may resurface. As we saw in 2018-2019, tariffs on U.S. ag exports (e.g., soybeans, nuts, pork) led to sudden demand drops, lost sales, and a scramble to find alternative markets with longer, more complex logistics paths (Congressional Research Service, 2019).

Port Diversions Add Pressure Elsewhere:

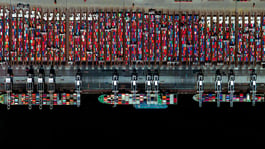

The Port of Savannah reported a 22.5% YoY increase in container throughput in March 2025, absorbing diverted cargo from West and Gulf Coast ports facing congestion or carrier omissions (GPA/eeSea, 2025). While Savannah has handled the surge well so far, exporters should be aware that:

- East Coast infrastructure may become strained if volumes continue to shift eastward

- Inland rail and drayage networks are being reconfigured around new routing patterns

- Exporters reliant on fixed gateways should re-evaluate port flexibility and inland access

What Exporters May Not See Coming:

Several broader forces are converging that may further disrupt vessel schedules, container availability, and inland logistics:

- Economic Rebound Uncertainty: If consumer demand or overseas economies recover faster than expected, vessel space could tighten quickly, leading to equipment shortages and renewed congestion.

- Global Disruptions in Canal & Conflict Zones: Drought in the Panama Canal, security disruptions in the Red Sea, and potential U.S. port labor unrest all pose risks to vessel routing and port schedules.

- Export Backhaul Pressure: As carriers chase higher-yield import cargo, U.S. ag exports could be deprioritized. This may lead to fewer empty containers made available inland and increased rolled bookings.

- AI-Driven Visibility Tools: Emerging AI tools like eeSea’s schedule reliability models, Xeneta forecasts, and TradeLanes’ Vessel Schedule Monitor (Ava) are helping shippers anticipate delays and congestion before it hits. Exporters not leveraging this tech will fall behind.

- Carbon Efficiency & Vessel Speed: IMO regulations are prompting carriers to reduce speed (slow steaming) and optimize routes to cut emissions, which extends transit times and reduces weekly sailing frequency.

- Port Diversion & Inland Network Shifts: Growing volume at East Coast ports like Savannah is shifting inland rail patterns. Exporters need to re-evaluate where and how containers are gated in - and whether alternate ports and ramps are viable.

- Contracting & SLA Strategy: With blank sailings being used as a contract-season tactic, exporters should push for flexible volume bands, alternate routing clauses, and equipment availability SLAs in their long-term agreements.

Real Cost Impacts from April Scenarios:

- Storage fees: $50-$100 per container/day

- Per diem: $25-$50 per day

- Drayage yard hold: $850 for 5 days

- Alternate warehouse shift: $1,575 per container

- Cross-town rail re-routing: $775 per container

(Source: Harrell, 2024a)

Actionable Steps for Exporters:

- Use real-time rail visibility tools to track ERDs, rail CY cutoffs, and billing status (Harrell, 2024b).

- Push carriers for ERD updates early and clarify whether your booking is still viable given blank sailings.

- Scenario-plan with warehousing and drayage partners for delays, port changes, or sudden market shifts.

- Engage your trade team to prepare for possible retaliatory tariffs - diversifying buyers and reviewing pricing strategies may be necessary (Congressional Research Service, 2019).

- Negotiate more free time at inland ramps or alternate routing clauses in your service contracts to absorb disruptions (Harrell, 2024a).

- Reassess port and inland network strategy. Consider gateways like Savannah, but monitor East Coast congestion indicators and prepare for volume swings.

- Update contracts with flexibility. Add clauses for alternate gateways, space prioritization, volume elasticity, and equipment guarantees in preparation for Q2/Q3 demand volatility.

- Invest in predictive visibility. Use AI tools like TradeLanes Vessel Schedule Monitor (Ava) or eeSea’s SRS to make data-driven booking and routing decisions.

The Big Picture:

This isn’t just a logistics issue. It’s a strategic one. Between blank sailings and tariff volatility, U.S. ag exporters face both operational delays and demand-side shocks. Learning from the 2018-2020 playbook, the exporters who weathered it best were those who:

- Tracked schedules obsessively (Sea-Intelligence, 2019)

- Built flexibility into their logistics stack (Harrell, 2024a)

- Advocated hard for reliable carrier support

If April is the start of another wave of disruption, now is the time to act - not react.

Want help building a visibility strategy to reduce risk across your inland ramps and export bookings? Let’s connect. I’m happy to walk through what top-performing exporters are doing right now.

#agexports #supplychainrisk #raildisruption #blanksailings #exportlogistics #tradelanes #visibility #vesselschedules

References

Angell, M. (2025, April 1). April blank sailings ramp up amid push to finalize long-term contracts. Journal of Commerce. https://www.joc.com/article/april-blank-sailings-ramp-up-amid-push-to-finalize-long-term-contracts-5974802

Congressional Research Service. (2019). China’s retaliatory tariffs on U.S. agriculture: In brief (Report No. R45929). https://crsreports.congress.gov/product/pdf/R/R45929

Harrell, V. (2024a). A Comprehensive Framework for Managing Inland Ramp and Vessel Schedule Disruptions for U.S. Exporters. TradeLanes.

Harrell, V. (2024b). Rail Visibility Explained: A Comprehensive Guide for U.S. Exporters of Agriculture, Food, and Commodities. TradeLanes.

Sea-Intelligence. (2019). Schedule Reliability in 2018. Sunday Spotlight, Issue 397.

eeSea. (2025, April 2). A tumultuous start to 2025: Global reliability. https://app.eesea.com/news/a-tumultuous-start-to-2025-global-reliability-eesea-schedule-reliability-scorecard

GPA/eeSea. (2025, April 3). GPA grows March container trade 22.5 percent. https://app.eesea.com/news/gpa-grows-march-container-trade-225-percent

Leave a Comment