There was good news, bad news, and just plain news for the US agricultural products exporting community the other morning, as Gene Seroka, Executive Director at The Port of Los Angeles, held a briefing to update the trade on a variety of West Coast shipping issues.

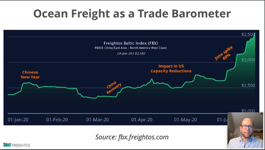

2020 has brought a series of challenges to the US exporting community, with several waves of COVID-19 related closures in both Asia and the US and on on-again-off-again trade war with China. Ocean carriers have blanked sailings, there have been chronic container shortages at many locations (especially inland in the US), and vessel schedule reliability has been extremely low. These factors have particularly affected the ag trade, where delays and changing schedules affect both quality of perishable goods and create significant extra expenses for the shipper.

The good news is that empty containers are coming into the US in record numbers. After 11 consecutive months of year-on-year volume declines, the port of LA has had two months of y-on-y increases; in fact, September 2020 was the best September in port history, with a 13.3% y-on-y increase in TEU throughput. Where historically the US has generated 1 export load for every 2.5 imports, the ration is now down to 1:3.5.

Schedule reliability is also returning. Compared to 67 blanked sailings in the second and third quarter of 2020, there were none recorded in September 2020.

These increases are attributable to a strong import market. While exports are flat compared to last year ( -0.3% in September ), imports are up an incredible 37%. The American economy shifted heavily towards consumption in 2020, with housewares, electronics, athletic wear, and leisure clothing all showing large increases in import volumes. After having very lean inventory most of the year, merchants continue to restock heavily in expectation of a strong holiday shopping season (kicking off with Amazon Prime Day this week.)

The bad news is that these containers aren’t making it to where they’re needed the most. Consumer goods are imported to major metropolitan areas or devanned on the coasts and moved inland by truck, leaving the empty containers far away from the rural growing areas where exports are generated. In September, despite the strong import performance, the Port of Los Angeles moved twice as many empty containers back to Asia as loaded exports.

Rail costs are a major factor, as both moving the empty container to where it’s needed as well as getting it back to a port for loading is expensive enough to destroy the margin on a commodity trade. Peter Friedman of the Agricultural Transportation Coalition, a lobbying and policy group representing US exporters, discussed various initiatives being worked on to help alleviate these burdens on the exporter, including new inland container depots being opened as well as regulatory and commercial approaches. He emphasized that these problems are in many cases structural, and require constant attention and work to be minimized.

More importantly, a renewed focus on efficiency and proactive communications was touted as the best way for the industry as a whole to address these challenges. Supply chain is a circular network, vessel schedules and container availability drive innumerable downstream effects; getting information into the hands of exporters (who often need 2-3 weeks lead time to get a shipment delivered at an inland ramp to meet a given vessel, but have narrow and constantly shifting delivery windows that generate enormous costs if not adhered to) as early as possible will help.

Exporters also need to be more organized, taking advantage of technological solutions that help them better plan and execute global trades on a tight schedule.

And if you're interested in that, please connect with us at hello@tradelanes.co.

Leave a Comment