Almost overnight, most companies have changed the way that they see the risk landscape. It seems investors have too. "Social" risk has come to life in dimensions that are startling to many executives – and seem to foreshadow a new world of risk management in the future. On a call this week with BlackRock, Goldman Sachs, and Putnam Investments, there was a dominant view that having invested (both as an investor and as a company) in ESG risk management in the past is paying off (relatively):

- 90% of companies with ESG strategies have outperformed their counterparts.

John Goldstein from Goldman Sachs shared stats:

- 44% ESG funds in top quartile

- Only 11% ESG in bottom quartile

- 24 of 26 ESG index funds outperformed

It's proving out that proactive ESG (Environment, Social, Governance) strategies are just good risk management. Arguably, ESG investing needed a stress test; and Covid-19 has shown that ESG can take a punch and stand tall. That’s to say that by looking at risk with an ESG lens, companies and investors are more likely to perform better.

ESG risk management more important than ever

These investors say that the companies managing ESG strategically instill faith that they understand and are managing what the future of risk really looks like. And it seems investors are walking the talk.

- There were record inflows into ESG indexes and companies the first quarter.

- BlackRock is overhauling its investment strategy because of climate change, putting ESG at center, and has committed another 1T for ESG funds.

These kinds of changes mean that companies that invest in ESG will be rewarded through the capital markets.

BlackRock’s Head of International and of Corporate Strategy Mark Weidman says: “Fundamentally our clients hire BlackRock to make them money… when we look at the landscape, we think that there is going to be a fundamental realignment of capital” with investors and companies looking at “all real parts of risk.”

With Covid-19, the “S” of ESG (Environment Social Governance) which includes employee and labor issues, product liability, data security, stakeholder opposition has all of a sudden become an axis of focus of every company.

More than ever it seems that non-financial risk needs to be at the center of the process for investors to be good fiduciaries – which means integrating ESG strategies is, more than ever, material to a company’s success.

Weidman says he will be paying very close attention to how companies are integrating ESG strategies to come out of the crisis in a healthy way – and to be able to create value for stakeholders going forward.

But how does this change the landscape going forward?

There may be no better time to revisit ESG risks and strategies

Covid-19 has shown that boards and the C-Suite can quickly get organized around S risk; and arguably, the pandemic has pushed ESG farther into the board room than ever before. When else do you have boards and investors worried if employees will be able to manage child care duties, work remotely, stay healthy, and remain productive?

If BlackRock, Goldman Sachs, Just Capital, and Putnam have it right, it seems that all companies should be reviewing their non-financial risk, and that includes (maybe even prioritizes) their ESG strategies. There may be no better time to go beyond the box checking exercise, revisit the key sustainability questions for any organization - which ARE your future risks, and start looking at ESG as long-term value creation.

Here are a few key questions for exec teams:

- How prepared were your S strategies when Covid hit?

- Are you ready if there is a fundamental shift to reward leaders in ESG risk management in the capital markets?

- How much of ESG is in the luxury bucket and how much are investments that make the company stronger over time?

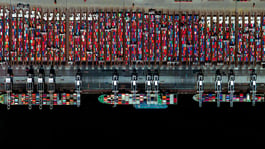

What it means for the future – and for the large commodity merchants with which TradeLanes works?

I remember in the first weeks of the Covid-19 crisis blazing the markets, environmental NGOs were using the opportunity to talk about climate change. I could not help but think “wow, how tone deaf.” But, in retrospect, I have to admit, maybe this is exactly the right time to talk about change. Maybe they're just not telling the right story.

Covid-19 has shoved in our faces the need to look at risk (and opportunity) entirely differently. Companies will struggle with the drastic implication on the ‘S’ of ESG for some time to come. But this pandemic is also a clear harbinger warning companies to figure out how to manage E (environmental) and G (governance) in much more proactive ways.

For TradeLanes, a company built around delivering to a sustainable circular economy, companies caring more about managing ESG risk is a good thing.

As we dig (deep) to find silver linings from this pandemic, it may be that there are companies that are managing to take this set of circumstances – although terrible and unwelcome – to do better in the future and prepare for what is a brave new world.

Thanks to Goldman Sachs for sponsoring an interesting webinar this week with Mark Wiedman, Head of International and of Corporate Strategy, BlackRock; Katherine Collins, Head of Sustainable Investing, Putnam Investments; Martin Whittaker, Chief Executive Officer, Just Capital; and John Goldstein, Head of the Sustainable Finance Group, Goldman Sachs.

TradeLanes is a technology company that is transforming global trade – making it faster, easier, and more profitable for businesses to trade with other businesses. Please sign up for our blog here; follow us on LinkedIn, and Twitter; or email us.

Leave a Comment